The Of Affordable Bankruptcy Lawyer Tulsa

Table of ContentsThe Greatest Guide To Bankruptcy Attorney Near Me TulsaThe 10-Minute Rule for Affordable Bankruptcy Lawyer TulsaWhat Does Top Tulsa Bankruptcy Lawyers Mean?The 2-Minute Rule for Top-rated Bankruptcy Attorney Tulsa OkThe 8-Minute Rule for Which Type Of Bankruptcy Should You File

The statistics for the other primary type, Chapter 13, are even worse for pro se filers. Suffice it to state, speak with a legal representative or 2 near you that's experienced with bankruptcy regulation.Numerous attorneys likewise offer cost-free appointments or email Q&A s. Take benefit of that. Ask them if bankruptcy is without a doubt the appropriate choice for your circumstance and whether they assume you'll qualify.

Ads by Cash. We might be compensated if you click this advertisement. Advertisement Since you've decided insolvency is indeed the appropriate program of action and you ideally removed it with a lawyer you'll require to get going on the documents. Before you study all the main bankruptcy types, you need to get your very own papers in order.

The 4-Minute Rule for Bankruptcy Lawyer Tulsa

Later on down the line, you'll actually require to show that by disclosing all kind of information concerning your economic affairs. Right here's a basic list of what you'll need when driving in advance: Recognizing documents like your chauffeur's certificate and Social Security card Income tax return (as much as the past 4 years) Evidence of revenue (pay stubs, W-2s, self-employed incomes, revenue from assets in addition to any kind of earnings from federal government advantages) Bank statements and/or pension declarations Proof of worth of your properties, such as automobile and realty appraisal.

You'll desire to comprehend what type of financial debt you're attempting to fix.

You'll desire to comprehend what type of financial debt you're attempting to fix.If your income is as well high, you have one more alternative: Phase 13. This choice takes longer to settle your financial debts due to the fact that it calls for a long-lasting settlement strategy normally 3 to five years before several of your remaining financial obligations are cleaned away. The filing procedure is additionally a whole lot more intricate than Chapter 7.

The Ultimate Guide To Tulsa Debt Relief Attorney

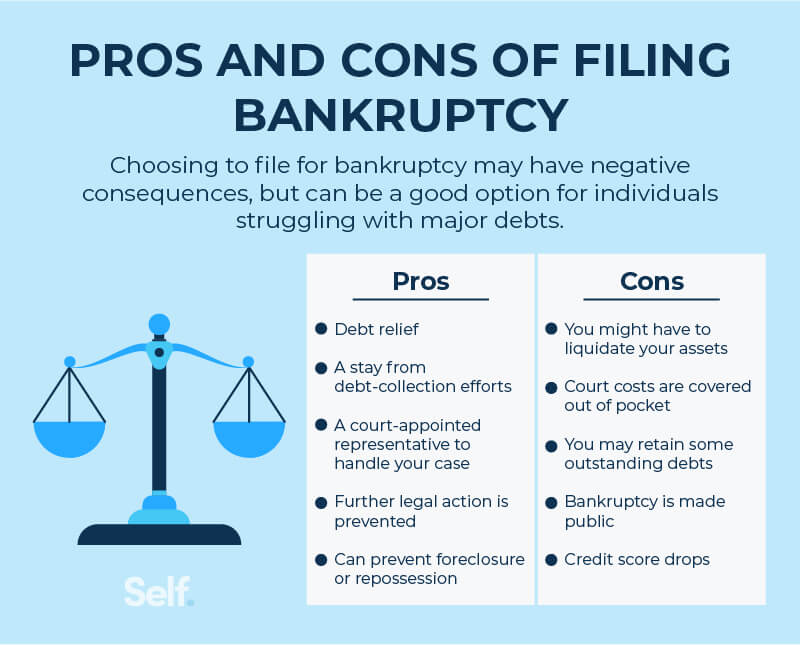

A Phase 7 personal bankruptcy remains on your credit rating report for one decade, whereas a Chapter 13 bankruptcy drops off after seven. Both have lasting influences on your credit rating, and any type of brand-new financial debt you get will likely include greater rates of interest. Prior to you send your insolvency forms, you should initially complete a necessary course from a credit score counseling company that has actually been approved by the Division of Justice (with the notable exemption of filers in Alabama or North Carolina).

The program can be finished online, in individual or over the phone. Training courses generally set you back between $15 and $50. You should complete the program within 180 days of declare insolvency (Tulsa bankruptcy lawyer). Utilize the Department of Justice's website to locate a program. If you reside in Alabama or North Carolina, you need to select and complete a program from a list of individually approved service providers in your state.

Not known Facts About Top-rated Bankruptcy Attorney Tulsa Ok

A lawyer will usually manage this for you. If you're filing on your own, know that there are concerning 90 various bankruptcy areas. Inspect that you're filing with the proper one based on where you live. If your permanent home has relocated within 180 days of filling up, you ought to file in the district where Tulsa bankruptcy attorney you lived the greater section of that 180-day duration.

Commonly, your personal bankruptcy attorney will certainly function with the trustee, but you may require to send out the person documents such as pay stubs, tax returns, and bank account and credit card declarations straight. A typical false impression with bankruptcy is that once you submit, you can quit paying your debts. While personal bankruptcy can assist you wipe out several of your unsecured financial obligations, such as past due clinical expenses or personal fundings, you'll want to keep paying your month-to-month repayments for secured debts if you want to keep the home.

Some Known Factual Statements About Tulsa Bankruptcy Consultation

If you go to risk of repossession and have worn check out the post right here down all various other financial-relief choices, then filing for Phase 13 may postpone the repossession and assist in saving your home. Inevitably, you will still require the earnings to continue making future mortgage repayments, along with settling any kind of late settlements throughout your layaway plan.

The audit could delay any kind of financial debt relief by several weeks. That you made it this far in the procedure is a respectable sign at least some of your debts are eligible for discharge.